Leading Wealth Management Company

ATAK cut lead transfer from days to minutes with a HubSpot-Salesforce integration.

The Situation

A Leading Wealth Management Company faced significant operational challenges due to disconnected systems. The company’s marketing team relied on HubSpot to manage marketing-qualified leads (MQLs) and nurture potential clients. Meanwhile, their sales team operated within Salesforce, enhanced by Practifi, a specialized overlay designed for the financial services industry.

However, the lack of integration between HubSpot and Salesforce caused inefficiencies:

Manual Lead Transfer: MQLs identified in HubSpot were manually emailed to the operations team. From there, they were manually entered into Salesforce—a process that could take days to complete.

Limited Analytics: Disjointed systems meant that the company lacked full-funnel visibility, making it impossible to track the progress of leads from marketing to sales. This severely hindered attribution reporting and prevented insights into which campaigns converted leads into clients.

Data Duplication and Errors: Without synchronized systems, the marketing team had to frequently export and re-import data from Salesforce into HubSpot to ensure accurate email targeting and segmentation. This repetitive process increased the risk of data errors.

The Solution

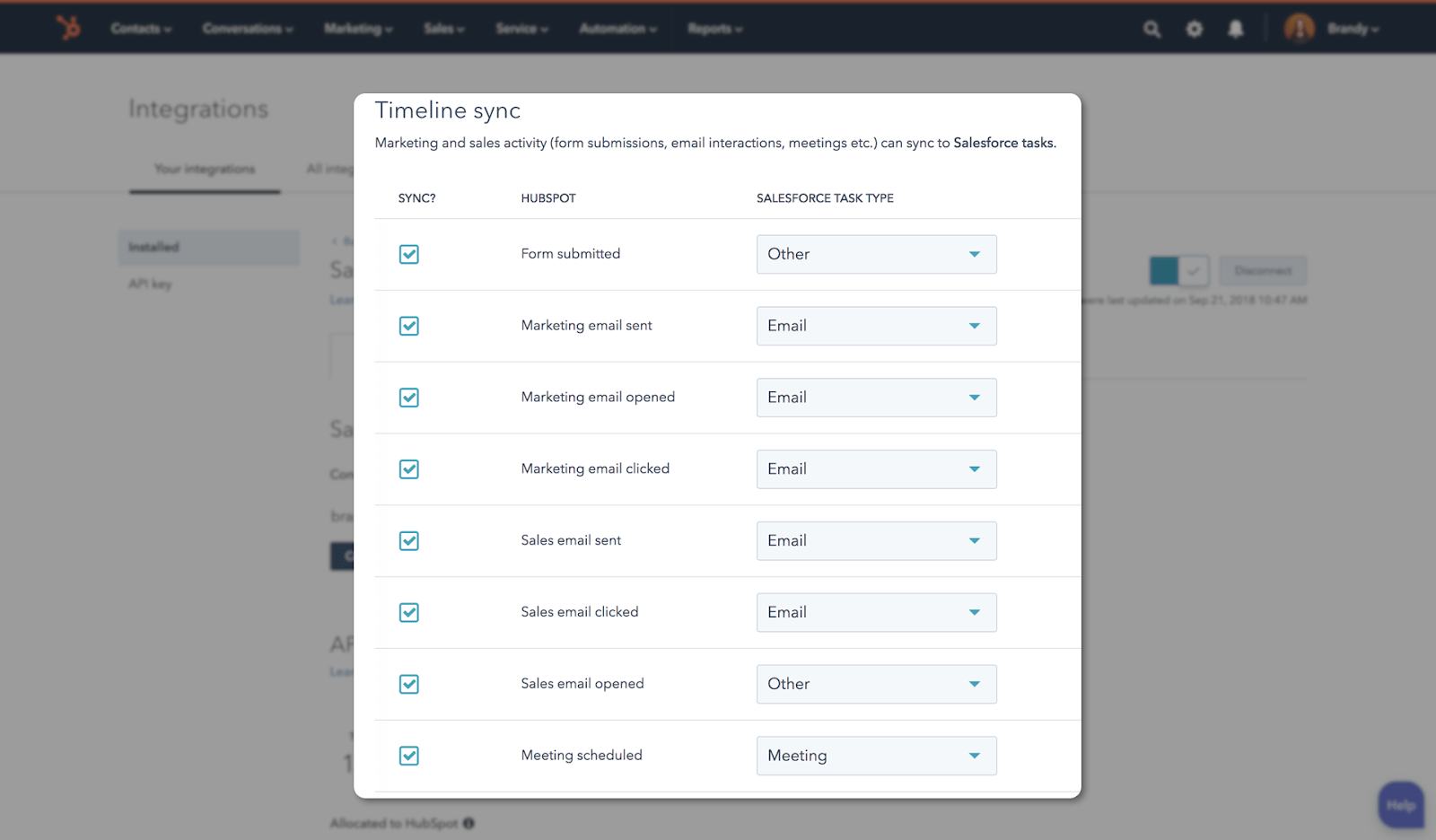

Our team at ATAK Interactive implemented a comprehensive HubSpot-Salesforce integration to streamline the client’s operations. This integration was tailored to meet the unique needs of a financial services company, including the complexities of Practifi’s custom architecture.

Key Actions Taken:

Custom Object Syncing: Practifi’s structure uses custom objects, such as “relationship objects,” to track how individuals are associated with accounts (e.g., primary account holder, spouse, referrer). We replicated this custom architecture in HubSpot by creating a corresponding relationship object and associating it with relevant contacts and accounts. This ensured data consistency between HubSpot and Salesforce.

Automated Data Flow: API-based synchronization was established to automate lead transfer between HubSpot and Salesforce. Now, when leads are qualified in HubSpot, they are automatically passed to Salesforce without manual intervention.

Enhanced Reporting: With unified systems, we implemented full-funnel reporting capabilities. This allowed the client to track the entire customer journey, from lead generation in HubSpot to deal closure in Salesforce. Key metrics like conversion rates, deal progression, and campaign ROI are now available in real time.

Streamlined Email Targeting: The integration eliminated the need for frequent manual data imports. Now, HubSpot can directly access real-time client and lead data from Salesforce, enabling the marketing team to create targeted email campaigns without risk of inaccuracies.

The Result

The integration yielded transformative results for the client:

Drastically Improved Speed-to-Lead: The time taken to transfer leads from marketing to sales was reduced from two days to seven minutes. This dramatic improvement ensures potential clients are contacted promptly, increasing the likelihood of conversion.

Increased Operational Efficiency: By automating lead transfer and data synchronization, the client eliminated hours of manual work daily. The operations team can now focus on higher-value tasks.

Accurate Attribution Reporting: Full-funnel visibility enables the client to identify which marketing efforts directly contribute to revenue. This allows for data-driven decision-making and more effective allocation of marketing budgets.

Improved Data Accuracy: Real-time synchronization minimizes errors and ensures that both marketing and sales teams work with up-to-date information.

Seamless Collaboration: With synchronized systems, marketing and sales teams are more aligned than ever, enhancing overall team productivity.

Conclusion

Through the HubSpot-Salesforce integration, the Leading Wealth Management Company transformed its operations, achieving greater efficiency, improved reporting capabilities, and faster response times.

The project underscores ATAK Interactive’s expertise in solving complex integration challenges, enabling our clients to focus on what they do best—delivering exceptional financial services to their clients.

-1.webp?width=1074&height=690&name=salesforce%2001%20(1)-1.webp)

.webp?width=1929&height=1132&name=Screenshot%202023-06-16%20at%2010%20(1).webp)

Related Case Studies

Gaviña

The Situation YouBar is the leading nutrition bar manufacturer in the United States for protein...

%201.svg)

%201%20(1).png?width=700&height=392&name=Salesforce.com_logo%20(1)%201%20(1).png)